Amended Act on Compensation for Nuclear Damage

The amended Act on Compensation for Nuclear Damage was passed in the National Diet on December 5, 2018. Despite calls for major revisions, fundamental problems were not resolved. Provisions were kept in place to protect nuclear operators and shareholders, banks and manufacturers. The burden of compensation for the Fukushima Daiichi nuclear accident was shifted onto the public in order to avoid a TEPCO bankruptcy, and the same mechanism can be applied in the future as well. Here are six main problems with the amended Act.

(1) Amount of compensation completely inadequate

Article 6 of the Compensation Act states that “A nuclear operator shall not operate a nuclear reactor unless it has taken measures to compensate for nuclear damage,” and Article 7 states that this amount should be 120 billion yen. The operator is to secure compensation in case of an accident with two types of insurance: nuclear liability insurance and nuclear indemnity agreements. The compensation to victims in the Fukushima Daiichi accident is 8 trillion yen, and the decontamination costs are 6 trillion yen, so the estimated total required for compensation amounts to 14 trillion yen.1 It is clear to everyone that the current compensation amount of 120 billion as indicated in the Compensation Act is only one-hundredth or less of what is required. That is completely inadequate. Despite this, this amount has been maintained in the Act. The excuse given is that the insurance market cannot underwrite more than that. In other words, the insurance market has determined that the risk of nuclear power is too great. It is our view that if that is the case, nuclear plants should not operate.

(2) “Unlimited liability” and “no-fault liability” stay in Act (but seriously watered down)

The Federation of Electric Power Companies of Japan and other parties were calling for review and changes to the conventional “unlimited liability” (no limit set on compensation owed by nuclear operators) and “no fault liability” (nuclear operators are liable whether or not they are at fault), but unsurprisingly these were left unchanged. However, as described below, the “unlimited liability” was effectively watered down.

(3) Who are the protected ones? (Nuclear operators, shareholders, banks)

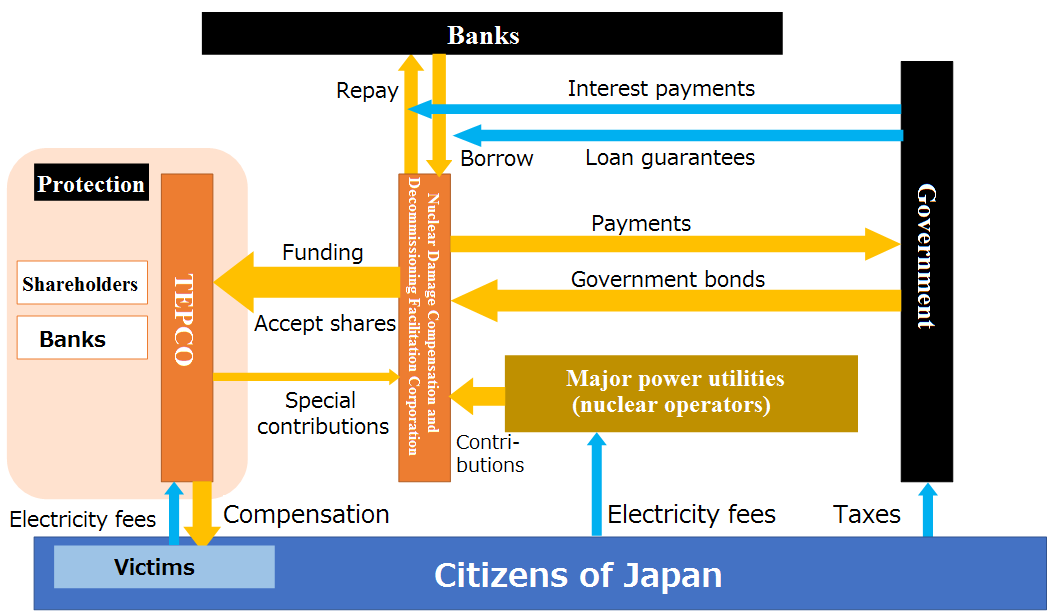

The government established the Nuclear Damage Compensation and Decommissioning Facilitation Corporation in 2011 to avoid the bankruptcy of TEPCO. It is a framework to pay TEPCO from government bonds, government-backed loans, and contributions from other utilities, etc. (Fig.).

Fig. Funds flowing to TEPCO via the Nuclear Damage Compensation and Decommissioning Facilitation Corporation

prepared by FoE Japan

TEPCO is exempted from legal restructuring, and the management, shareholders and banks lending to TEPCO bear no responsibility. Of the compensation funds issued through the Corporation, TEPCO only bears only 25.5 to 45.1%,2 and the remainder is borne by the people of Japan. The interest costs are estimated at 143.9 to 218.2 billion yen, and this is borne by the government.3

Article 16 of the Compensation Act states that if the damage exceeds the stated compensation amount, the government “provides the nuclear operator with the necessary support for the nuclear operator to compensate for the damage,” and this is the basis for the establishment of the Corporation. However, if the government provides assistance while the responsibilities of nuclear operators are obscured, the management, shareholders and creditors of nuclear operators will not be held liable.

(4) Is nuclear power “sound” development?

Article 1 of the Compensation Act states that its “purpose is to protect persons suffering from nuclear damage and contribute to the sound development of the nuclear industry.” However, it is strange to think that protection for victims and sound development of the nuclear industry should be given equal treatment. The purpose should be to protect victims.

(5) Need to fix the Dispute Reconciliation Committee for Nuclear Damage Compensation

Even though TEPCO promises to respect proposed settlements by Alternative Dispute Resolution (ADR), the fact is that it has rejected ADR settlement proposals over and over again. In an ADR class action case of 15,700 residents of Namie Town (filed January 31, 2013, closed on April 5, 2018), TEPCO rejected settlement proposals six times. By October 2018, over 900 of the applicants in the case had died, including the elderly. Unless the proposed settlement is obviously unreasonable, the nuclear operator should be obliged to accept it.

(6) Mandatory preparation and publication of compensation implementation policies

Under the amended Act, a nuclear operator is required to prepare and publish a policy on the implementation of compensation (Article 17-2). However, no details are provided, and there is no consideration of adequacy of the policies. The Act should include provisions stipulating that third parties must check the contents of the policies and that no nuclear plant should be operated if the policies are inadequate.

- Report of the METI 1F Committee on TEPCO Reform, December 20, 2016.

- Board of Audit of Japan, “Report on results of audit on the state of implementation of government support relating to compensation for the nuclear damage concerning TEPCO” (March 2018).

- Ibid.